Our friends at This Old House wrote up a detailed primer on renovation loans and we thought we would share it. There are many ways to go about securing financing for a renovation. You’ll also find some links on our website of local banks and contacts we have used and recommend. The best time to start thinking about financing is right now.

Until recently, borrowing money for a new kitchen, second-story addition, or other home improvement meant going to the bank, seeing a loan officer, and hoping for the best. Today, however, you have many more options. A mortgage broker, for example, can offer more than 200 different loan programs. And brokers are just one of the many lenders eager to put together a loan that fits your situation — even if your credit history is less than perfect.

That means you might be able to borrow more money than you think. But with so many competing lenders, loan options, and terms, it also means loan shopping can be as challenging as house hunting. You can skip all the confusion and land on the right lending program by:

1. knowing how much money you need and roughly how much you can get from the start

2. narrowing the myriad loan options down to the ones that match your needs and finances

3. concentrating on the lenders that are likeliest to provide the type of loan you want.

How Much Can You Borrow?

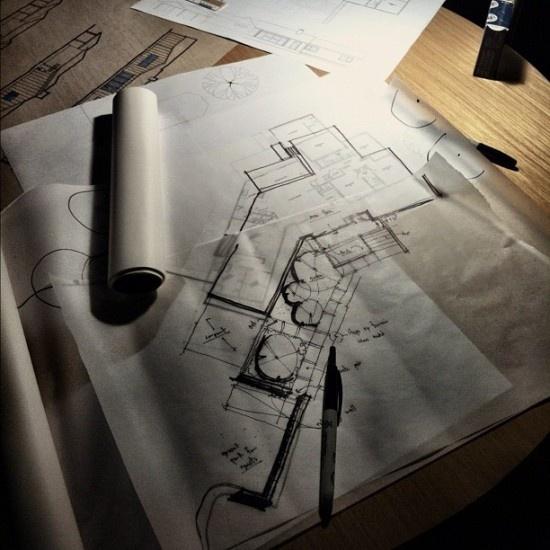

Whether you hire a contractor or take on the work yourself, begin with an accurate estimate of what the project will cost. Lenders will insist on a specific figure before they work with you. If you’re hiring a contractor, start with a firm bid, broken down into labor and materials. Then add on 10 percent for surprises. On work you’ll do yourself, compile a detailed materials list with quantities, costs, and an accurate total. Include permit fees and equipment rental. Then add a cushion of 20 to 30 percent to be safe. Once you know how much you need, how much will you get? Despite the promises and hype lenders make in their ads and promotional materials, how much you can borrow hinges on your credit rating, the loan-to-value ratio, and your income. These factors also help determine the interest rate, the length of the loan, and whether you’ll pay points. Your credit rating. The best rates and terms go to homeowners with an A rating — no late payments in the last 12 months and no maxed-out credit cards. One or two late payments or overdrawn credit cards probably won’t knock you out of the game, but you might end up with a higher interest rate and a smaller loan.

Loan-to-value ratio. To determine the loan amount, lenders use the loan-to-value ratio (LTV), which is a percentage of the appraisal value of your home. The usual limit is 80 percent — or $100,000 for a $125,000 home (.805125,000). Lenders subtract the mortgage balance from that amount to arrive at the maximum you can borrow. Assuming your balance is $60,000, the largest loan that you can obtain is $40,000 ($100,000-$60,000=$40,000). If you have a good credit rating, a lender might base your loan on more than 80 percent of the LTV; if you don’t, you might get only 65 to 70 percent. While many lenders go to 100 percent of the LTV, interest rates and fees soar at these higher ratios.

Your income. If you also have high expenses, a high income level might not mean a larger loan. Lenders follow two rules to minimize their risk:

•Your house payment and other debt should be below 36 percent of your gross monthly income.

• Your house payment alone (including principal, interest, taxes, and insurance) should be no more than 28 percent of your gross monthly income. The maximum debt-to-income ratio rises to 42 percent on second mortgages. Some lenders go even higher, though fees and rates get expensive — as will your monthly payment. However, a debt-to-income ratio of 38 percent probably is the highest you should consider carrying.

The LTV determines how much you can borrow, and your debt-to-income ratio establishes the monthly payment for which you qualify. Within these two limits, the biggest trade-offs are interest rates, loan term, and points.

Interest rates. The less interest you pay, the more loan you can afford. An adjustable-rate mortgage (ARM) is one way to lower that rate, at least temporarily. Because lenders aren’t locked into a fixed rate for 30 years, ARMs start off with much lower rates. But the rates can change every 6, 12, or 24 months thereafter. Most have yearly caps on increases and a ceiling on how high the rate climbs. But if rates climb quickly, so will your payments.

Loan term. The longer the loan, the lower the monthly payment. But total interest is much higher. That’s why you’ll pay far less for a 15-year loan than for a 30-year loan — if you can afford the higher monthly payments.

Points. Each point is an up-front cost equal to 1 percent of the loan. Points are interest paid in advance, and they can lower monthly payments. But if your credit is less than perfect, you’ll probably have to pay Loan shopping often starts with mainstream mortgages from banks, credit unions, and brokers. Like all mortgages, they use your home as collateral and the interest on them is deductible. Unlike some, however, these loans are insured by the Federal Housing Administration (FHA) or Veterans Administration (VA), or bought from your lender by Fannie Mae and Freddie Mac, two corporations set up by Congress for that purpose. Referred to as A loans from A lenders, they have the lowest interest. The catch: You need A credit to get them. Because you probably have a mortgage on your home, any home improvement mortgage really is a second mortgage. That might sound ominous, but a second mortgage probably costs less than refinancing if the rate on your existing one is low. Find out by averaging the rates for the first and second mortgages. If the result is lower than current rates, a second mortgage is cheaper. When should you refinance? If your home has appreciated considerably and you can refinance with a lower-interest, 15-year loan. Or, if the rate available on a refinance is less than the average of your first mortgage and a second one. If you’re not refinancing, consider these loan types: Home-equity loans. These mortgages offer the tax benefits of conventional mortgages without the closing costs. You get the entire loan up front and pay it off over 15 to 30 years. And because the interest usually is fixed, monthly payments are easy to budget. The drawback: Rates tend to be slightly higher than those for conventional mortgages. Home-equity lines of credit. These mortgages work kind of like credit cards: Lenders give you a ceiling to which you can borrow; then they charge interest on only the amount used. You can draw funds when you need them — a plus if your project spans many months. Some programs have a minimum withdrawal, while others have checkbook or credit-card access with no minimum. There are no closing costs. Interest rates are adjustable, with most tied to the prime rate. Most programs require repayment after 8 to 10 years. Banks, credit unions, brokerage houses, and finance companies all market these loans aggressively. Credit lines, fees, and interest rates vary widely, so shop carefully. Watch out for lenders that suck you in with a low initial rate, then jack it up. Find out how high the rate rises and how it’s figured. And be sure to compare the total annual percentage rate (APR) and the closing costs separately. This differs from other mortgages, where costs, such as appraisal, origination, and title fees, are figured into a bottom-line APR for comparisons simply to get the loan.

Which Lender for What?

For a home equity line of credit, the best place to start is your own bank or credit union. Both usually offer lower rates to depositors. Check other sources to be sure. If you get a second mortgage, refinance, or opt for an FHA 203(k) mortgage, you’re better off talking with a mortgage broker. A broker has more loan sources to choose from. When looking for a broker, check with people you know, and check any references you get. Contractors are another source of financing, but be wary: It’s hard enough to choose a contractor and a loan when they’re separate. And be suspicious of contractors who emphasize the monthly payment instead of the total cost of the job. A borrower’s bill of rights. Article Z of the federal Truth in Lending Act makes sizing up lenders and loans easier. It requires lenders to disclose interest rate, terms, costs, and variable-rate features in a total APR, a bottom line you can use to compare loans. Here are some other rights to remember:

• If a mortgage lender does not disclose the APR, any application fees must be refunded. You usually get these disclosures on a form with your loan application. If any terms change before closing, the lender must return all fees if the changes make you decide not to proceed.

• You have three days from the day of closing to cancel. Inform the lender in writing within that period and fees are refunded.